nanny tax calculator texas

Our nanny tax calculator will help you to calculate nanny pay and determine your tax responsibility as a. TEXAS LABOR LAWS Minimum Wage.

The True Cost To Hire An Employee In Texas Infographic

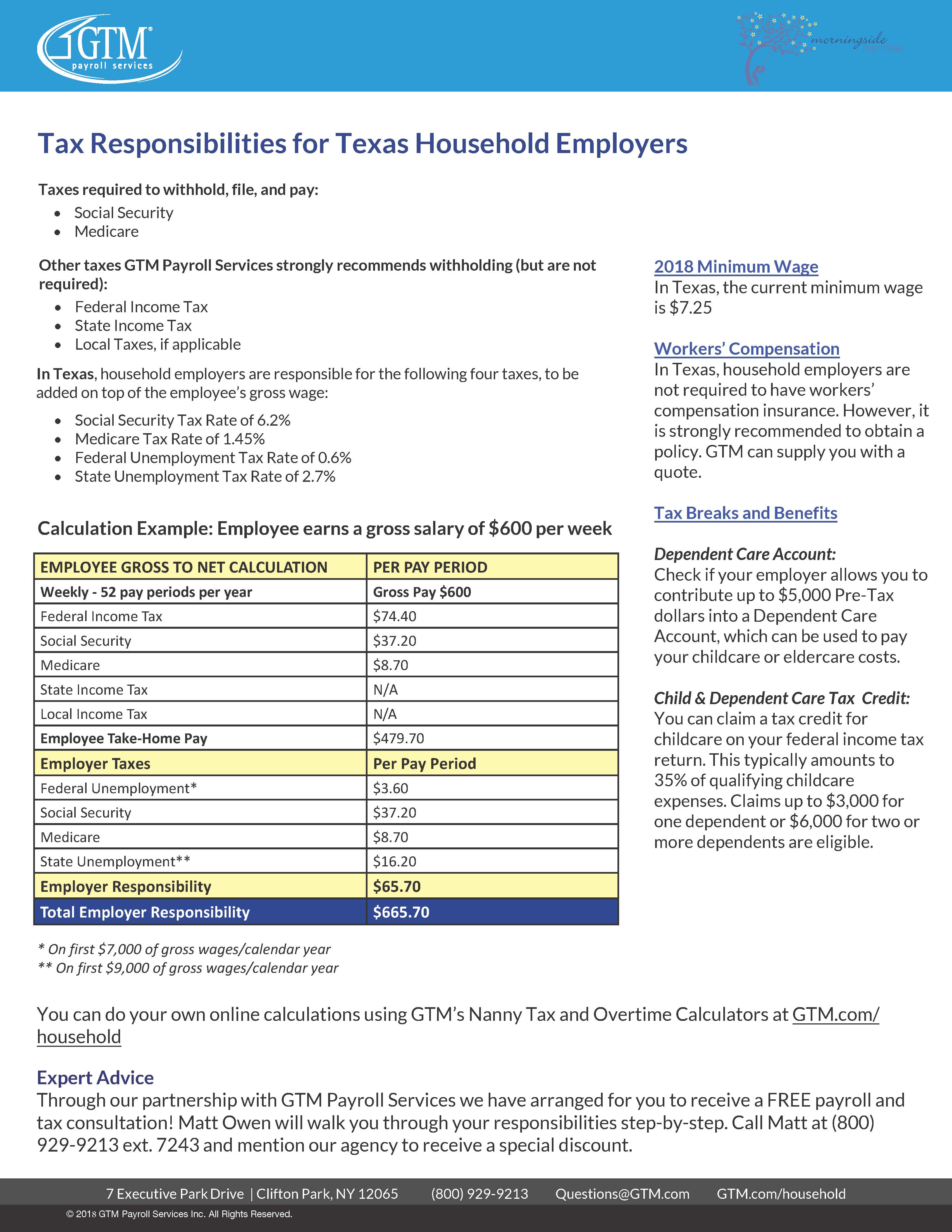

Like other employers parents must pay certain taxes.

. This grey area can lead to. This is 8 lower -2598 than the average nanny salary in the United States. This is based on the 20212022 tax year using tax code 1257Lx.

Our Easy-To-Use Budget Calculator Will Help You Estimate Nanny Taxes. TWC Rules 815107 and 815109 require all employers to report Unemployment Insurance UI wages and to pay their quarterly UI taxes electronically. Our Easy-To-Use Budget Calculator Will Help You Estimate Nanny Taxes.

Use Salary vs Overtime to calculate employee overtime pay. Our new address is 110R South. Ad Payroll So Easy You Can Set It Up Run It Yourself.

Use GrossNet to estimate your federal and state tax obligations for a household employee. The average nanny gross salary in Texas United States is 30422 or an equivalent hourly rate of 15. Taxes Paid Filed - 100 Guarantee.

Understand your nanny tax and payroll obligations with our nanny tax calculator. The Nanny Tax Company has moved. If you pay your nanny cash wages of 1000 or more in a calendar quarter or 2400 in a calendar year file Schedule H.

Taxes Paid Filed - 100 Guarantee. Good news though NannyPay offers a low-cost and up-to-date. Nanny Taxes Youre Responsible for Paying The nanny tax isnt just Social Security and Medicare taxesreferred to as FICA taxesthat are normally split evenly between an.

Cost Calculator for Nanny Employers. The Nanny Tax Company - Nanny Tax Prep Services. Our easy-to-use budget calculator will help you estimate nanny taxes and identify potential tax breaks.

Calculate pay and withholdings using The Nanny Tax Companys hourly nanny tax calculator or salary calculator. This calculator assumes that you pay the nanny for the full year and uses this amount as the basis to calculate what you need to pay per month. Any employee pension payments will.

Ad Payroll So Easy You Can Set It Up Run It Yourself. Employers that do not. If you plan to employ your nanny for less.

When it comes to working in peoples homes the working arrangements are often casual and wages are paid out in cash. These rates are the default rates for employers in Pennsylvania in a locality that. Texas defers to the FLSA which requires that all domestics excluding companions be paid at no less than the greater of the state or.

This calculator allows you to get an idea of how much you will pay and how much your nanny will take home. Using a calculator that is not current may cost you and your employee when filing tax returns and other reporting documents. Nanny tax and payroll calculator.

The Nanny Tax Company has moved. Our new address is 110R South Prospect Ave Park Ridge IL 60068. On a quarterly basis.

If parents pay a nanny more than 2100 wages in 2019 the nanny and the parents each pay 765 percent for Social. Form C-20 or C-20F for annual filing.

Full Service Nanny Tax Solution Poppins Payroll

Best Payroll Service For Small Business 1 Is Cheap

Free Payroll Tax Calculator Paycheck Calculation Fingercheck

2018 Nanny Tax Responsibilities

Nanny Tax Calculator Gtm Payroll Services Inc

Nanny Tax Payroll Calculator Gtm Payroll Services

Common Nanny Tax Questions Poppins Payroll

How Much Should I Hold Out For Taxes On 500 A Week In Texas I M A Nanny For A Family And They Don T Take Taxes Out Of My Pay Quora

Best Payroll Service For Small Business 1 Is Cheap

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

I Never Got Around To Paying My 2016 Nanny Taxes Is It Too Late

Nanny Tax Payroll Calculator Gtm Payroll Services

Nanny Tax Payroll Calculator Gtm Payroll Services

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

Household Employment Blog Nanny Tax Information W 2

The Temporary Nanny And Her Taxes

Nanny Tax Calculator Gtm Payroll Services Inc

Texas Tax And Labor Law Guide Care Com Homepay

Free Payroll Tax Calculator Paycheck Calculation Fingercheck